When borrowing money through a short-term loan, understanding interest rates is crucial. Interest rates determine how much extra you will pay beyond the principal loan amount, making it essential to evaluate different loan options carefully. Lenders set interest rates based on various factors, including creditworthiness, loan amount, and repayment terms.

How Interest Rates Are Determined

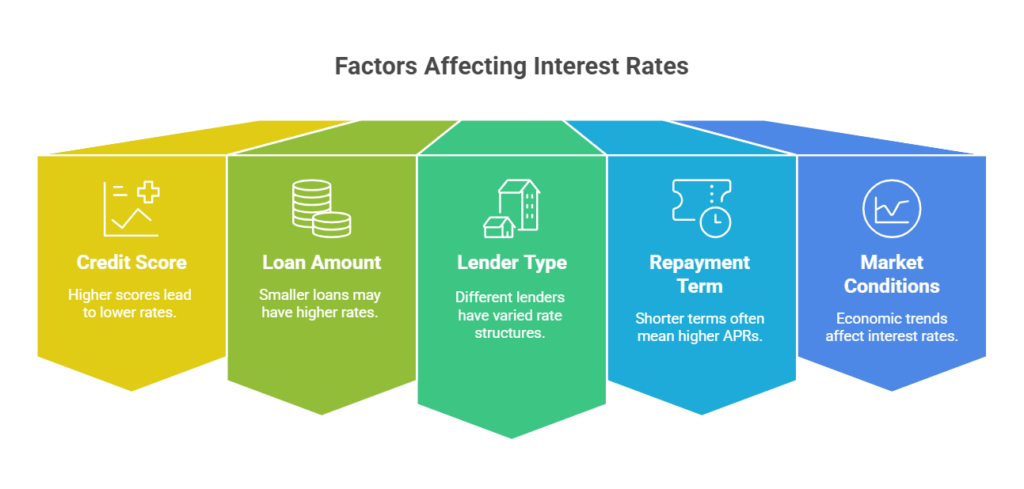

Lenders consider multiple factors when setting interest rates for short-term loans. Your credit score plays a significant role, as borrowers with higher credit scores typically receive lower interest rates. Lenders also assess income stability, debt-to-income ratio, and the risk associated with the loan before determining the rate.

Fixed vs. Variable Interest Rates

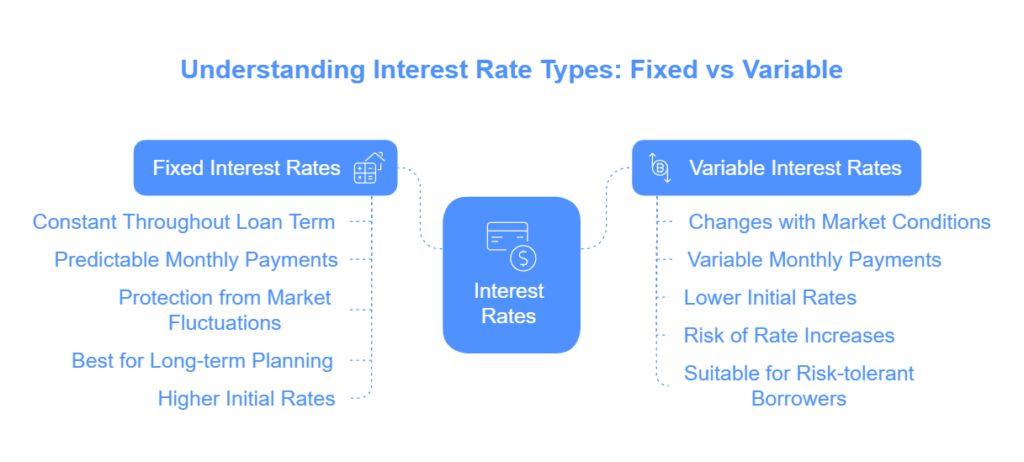

Short-term loans may come with fixed or variable interest rates. A fixed interest rate remains the same throughout the loan term, making it easier to plan repayments. Variable interest rates, on the other hand, fluctuate based on market conditions, potentially leading to higher or lower payments over time.

APR vs. Interest Rate

Annual Percentage Rate (APR) includes the interest rate along with other fees, such as origination fees or administrative costs. Comparing APRs instead of just interest rates gives a clearer picture of the total cost of borrowing. A loan with a low interest rate but high fees may be more expensive than one with a higher interest rate but fewer additional charges.

How Loan Terms Affect Interest Costs

Short-term loans generally have higher interest rates compared to long-term loans due to the increased risk for lenders. While the repayment period is shorter, the interest charged can still be significant. Borrowers should calculate the total repayment amount before agreeing to a loan to ensure affordability.

Reducing Interest Costs on Short-Term Loans

To minimize interest costs, borrowers can take several steps. Improving credit scores before applying can lead to lower rates. Shopping around for lenders and comparing offers can help secure the best possible deal. Additionally, paying off the loan early, if allowed, can reduce the total interest paid.

Understanding how interest rates work on short-term loans helps borrowers make informed financial decisions. Evaluating factors such as loan terms, APR, and creditworthiness ensures that you choose a loan that best fits your financial needs while keeping interest costs manageable.