Loan scams and predatory lending practices are a growing concern for borrowers looking for financial assistance. While many lenders operate legally, some take advantage of desperate borrowers by offering loans with hidden fees, exorbitant interest rates, and unfair terms. Understanding how to identify these scams can help you make informed financial decisions and protect yourself from financial harm.

Common Signs of Loan Scams

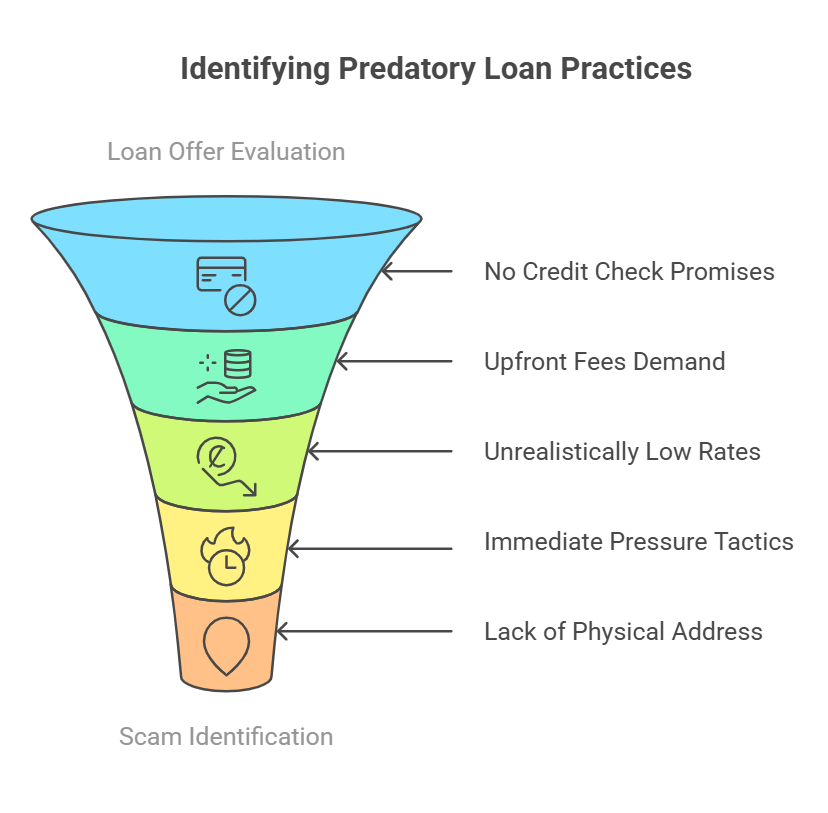

Not all lenders have your best interests at heart. Here are some red flags to watch out for when applying for a loan:

- No Credit Check Loans – Legitimate lenders assess your creditworthiness before approving loans. Scammers often promise guaranteed approval without a credit check, which is a major warning sign. While this may seem convenient, it often comes with outrageous interest rates and hidden fees that trap borrowers in debt.

- Upfront Fees Before Approval – Predatory lenders may ask for fees before disbursing the loan. Genuine lenders deduct processing fees from the loan amount rather than demanding upfront payments. Be cautious of lenders requesting wire transfers or prepaid debit card payments as a “processing fee.”

- Unrealistically Low Interest Rates – If an offer sounds too good to be true, it probably is. Some scammers lure borrowers with attractive rates but later impose hidden fees. Always read the fine print and ask for a full disclosure of the loan’s terms and conditions.

- Pressure to Act Immediately – Scammers often push borrowers to make rushed decisions, urging them to accept the loan without proper documentation or review. A legitimate lender will always give you time to assess your options and understand the repayment terms.

- No Physical Address or License – Reputable lenders have verifiable business addresses and state licenses. If a lender refuses to provide this information, it’s likely a scam. Always verify the lender’s registration with state or federal authorities.

Types of Predatory Lending Practices

Predatory lenders use various tactics to exploit borrowers. Some common schemes include:

- Loan Flipping – The lender encourages repeated refinancing, adding fees each time, which increases the borrower’s debt. This tactic is designed to make it nearly impossible to pay off the original loan.

- Bait-and-Switch Tactics – Borrowers are promised favorable terms but receive different, more expensive loan agreements upon signing. This can include higher interest rates, unexpected fees, or altered repayment periods.

- Hidden Fees and Prepayment Penalties – Some lenders bury fees in fine print or penalize borrowers for paying off loans early. This ensures that the borrower pays more over time than originally anticipated.

- Triple-Digit APR Loans – Payday and title loans often come with interest rates exceeding 300%, making repayment nearly impossible for many borrowers. Such loans can trap individuals in a cycle of borrowing just to cover previous debts.

- Fake Loan Offers – Scammers posing as lenders request sensitive personal information or upfront payments, then disappear without issuing the loan. These scams often operate through fake websites, email phishing schemes, or social media ads.

- Auto Title Lending – Lenders require borrowers to use their car title as collateral, offering short-term loans with extremely high interest rates. If payments are missed, borrowers risk losing their vehicles.

- Pyramid Lending Schemes – Some fraudulent lenders operate on a referral-based model, requiring borrowers to recruit others in exchange for loan approval. These schemes collapse quickly, leaving participants in financial distress.

How to Protect Yourself from Loan Scams

To avoid falling victim to loan scams, take the following precautions:

- Verify the Lender – Check if the lender is registered with state regulators and has positive customer reviews. Look for online reviews, Better Business Bureau (BBB) ratings, and consumer complaints before proceeding.

- Read the Fine Print – Always review loan agreements carefully and clarify any hidden fees before signing. If anything is unclear, consult with a financial advisor or lawyer.

- Compare Loan Offers – Research multiple lenders to identify the best loan terms. Never settle for the first offer you receive.

- Avoid Sharing Personal Information – Never provide sensitive details, such as your Social Security number or banking information, to unverified lenders. Scammers may use this information for identity theft.

- Ask for a Written Agreement – Verbal promises are not legally binding. Ensure that all loan terms, fees, and repayment schedules are documented in writing.

- Report Suspicious Lenders – If you suspect a scam, report the lender to the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB), or your state attorney general’s office.

- Trust Your Instincts – If something feels suspicious, don’t proceed with the loan. Walk away and explore safer, reputable lending options.

By staying informed and cautious, borrowers can avoid fraudulent lenders and secure loans from legitimate financial institutions that prioritize fairness and transparency. Awareness is the key to protecting yourself from financial exploitation and ensuring that your borrowing experience is safe and beneficial.